Get trusted insights and truly understand your clients' lives

Discover more data solutions that empower your analytics teams to make smart strategic decisions.

Maximise scoring accuracy with intelligent transactional data and gain a new layer of insight into your clients' daily lives and behaviours with 99.99% accuracy.

Are you absolutely sure you know and understand who your clients really are? What are their habits,needs or wishes? With enriched payment data, you know in an instant.​

Analyzing income, expenses, and behavior patterns can take time. Are you certain you truly know who your loan applicant is by the end?

Identifying a risky gambler from a successful manager with a family can be tricky. However, with a structured transaction history based on detailed payment categorization, merchant identification, and purchase location recognition, you’ll know immediately.

Empower your scoring model with structured insights from real-time transaction history data for any payment service, including PSD2

Boost your reputation by lending to creditworthy and trustworthy clients and prevent rising delinquencies with useful data insights

Uncover your client's subprime loan payment data and leverage these insights to perfectly target your offers or sell own subprime loans.

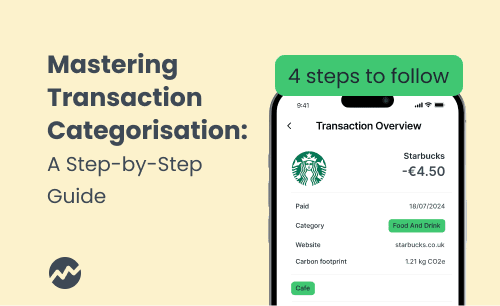

Tag and segment each individual transaction

Gain deep insights into specific client lifestyle and predict behaviour with a four-level transaction categorisation system.

Knowing where your clients live, where they pay and where they actually live will help you better understand and predict their living expenses.

Knowing where your clients live, where they pay and where they actually live will help you better understand and predict their living expenses.

şÚÁĎÍř enhances any payment type

Discover more data solutions that empower your analytics teams to make smart strategic decisions.

Gain deep insight into your clients' habits, needs and goals and predict their behaviour

Explore how şÚÁĎÍř can help you get the most from transaction data, increase your app engagement and turn UX into your competitive advantage.